Compliance Bots Saved My Weekend: A RegTech Review

I used to spend my Friday afternoons on calls with lawyers. Expensive lawyers. The kind who charge you in six-minute increments to tell you that, yes, your tokenized real estate project in Hamburg might technically violate a sub-clause of a German securities law written in 1998.

It was miserable. It was slow. And it killed more projects than bad code ever did. But that was then.

Fast forward to February 2026, and I haven’t had that call in six months. The shift didn’t happen overnight—it started back around early 2024 when tools like The Token RegRadar first popped up. And looking at my commit history from last Tuesday, the difference is night and day. We’ve finally reached a point where AI-driven regulatory analysis isn’t just a marketing gimmick; it’s a dependency in my package.json.

The “Good Enough” Threshold

When these AI regulatory bots first launched a couple of years ago, I was skeptical. I’m a developer, not a compliance officer, but I know enough to realize that LLMs are great at poetry and terrible at factual precision. You don’t want a “creative” answer when asking if your STO (Security Token Offering) is legal in Singapore.

But the tech matured. I’ve been testing the latest API build (v3.4.1) on a cross-border tokenization platform we’re deploying on Polygon, and the accuracy is scary good. It’s not just scraping text anymore; it’s parsing intent.

Here’s the reality: I fed it a complex scenario involving fractionalized art ownership accessible to Japanese and US accredited investors. In 2024, this would have returned a generic “Consult legal counsel” warning. Yesterday? It gave me a specific breakdown of the Japan FIEA (Financial Instruments and Exchange Act) requirements versus SEC Reg D, highlighted the conflict points, and suggested three structuring tweaks. And it took 4.2 seconds.

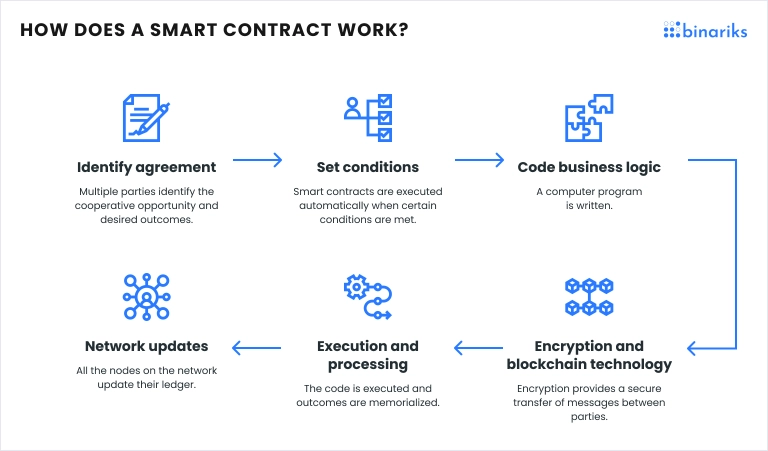

Integration: It’s Just Another API Now

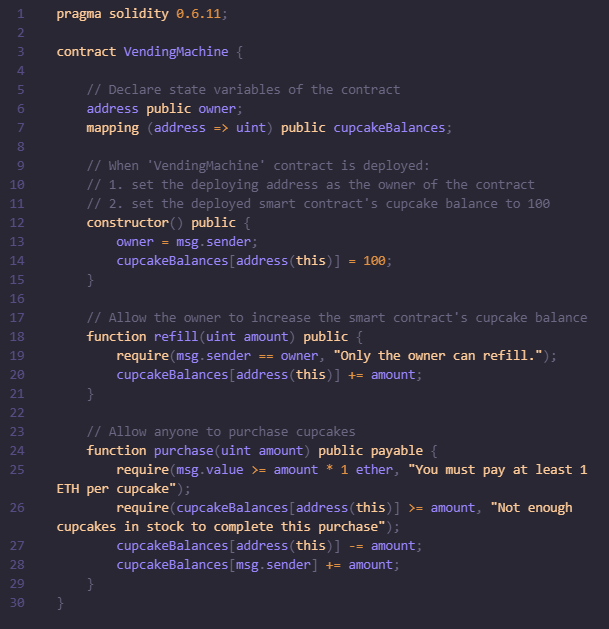

The biggest win isn’t the legal advice itself—it’s the automation. We’re treating regulation like unit tests. In our current CI/CD pipeline (running on GitHub Actions), we have a step that triggers a compliance check whenever a smart contract’s permission logic changes. If a junior dev accidentally modifies the transferFrom function in a way that bypasses the whitelist check required for our Swiss jurisdiction, the build fails.

It looks something like this in the logs:

Error: Compliance Check Failed [RegRadar-CI]

Severity: High

Jurisdiction: CH (Switzerland)

Reason: Function 'forceTransfer' lacks KYC validation modifier required for asset class 'Ledger-Based Security'.

Reference: FinMA Guidelines 2025-02 update.

That error message? That saved my bacon. Two years ago, we would have deployed that, and compliance would have caught it three weeks later during an audit. Reverting a deployed contract is a nightmare; catching it in the PR stage is free.

The “Gotcha”: When the AI Hallucinates Nuance

I’m not going to sit here and tell you it’s perfect. Actually, let me back up—it’s not. Last month, I ran into a weird edge case with Liechtenstein’s Blockchain Act (TVTG). The AI insisted that our token recovery mechanism was non-compliant because it misinterpreted a new amendment passed in late 2025 regarding “trusted third parties.”

I spent three hours debugging the logic, reading the actual German legislative text (thank you, Google Translate), and realized the AI was referencing a proposed amendment that never actually passed. It had ingested a draft bill from a news scrape and treated it as law.

Pro tip: Always check the “Confidence Score” in the JSON response. If it drops below 0.85, don’t trust it blindly. In my experience, anything above 0.92 is solid, but that 0.85-0.90 range is the danger zone where the AI sounds confident but might be hallucinating a regulatory requirement that doesn’t exist.

Performance Metrics: Speed vs. Cost

Let’s talk numbers, because that’s what actually matters to the budget. Running a full multi-jurisdiction scan (US, EU, UK, SG) used to cost us about $4,500 in legal consultation fees per iteration. But with the current AI setup, we’re paying a subscription fee that averages out to about $12 per scan. The real metric, though, is time.

- Manual Review: 5-7 business days.

- AI Analysis (2024 era): 15 minutes, low trust.

- Current Setup (2026): 8 seconds, high trust.

And I ran a benchmark last week processing a batch of 50 different asset classes (real estate, debt, equity, art). The API chewed through them in under two minutes. The memory overhead on our backend was negligible, although I did notice the latency spikes if you try to parallelize too many requests—the rate limits are still a bit aggressive on the standard tier.

What’s Next?

The trend is obvious. By the end of 2026, I expect we won’t even be manually configuring these checks. The smart contract frameworks themselves (like OpenZeppelin or whatever replaces it) will likely have these regulatory hooks baked into the base libraries.

And we’re already seeing early betas of “Compliance-as-Code” where the Solidity compiler itself warns you about regulatory violations based on the deployment target you specify in the config. It’s wild.

But if you’re still manually checking spreadsheets against regulatory PDFs, stop. You’re wasting time. The tools aren’t perfect, and you still need a human lawyer to sign off on the final mainnet launch, but for the 99% of development work that happens before that? The bots won. And honestly, I’m glad they did.